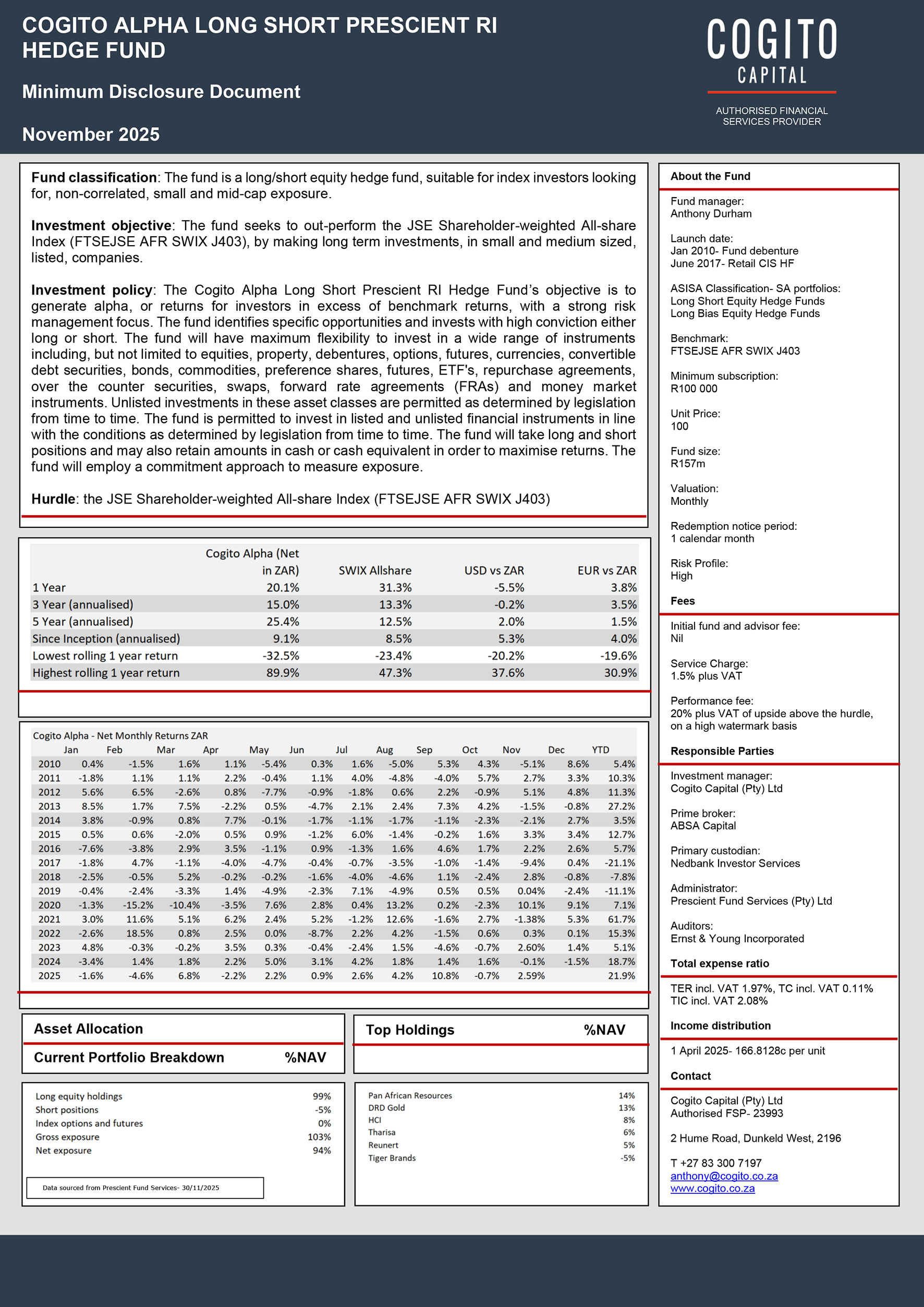

Minimum Disclosure Document

Minimum Disclosure Document

Holdings- Recent Results – November 2025

Araxi (AXX): 3.9% of the fund

Araxi is an exciting fintech business. Its Halo-Dot payments software has global potential:

Core Business:

Araxi’s core business is the importation and distribution of point-of-sale terminals (credit card machines). Araxi generates revenue primarily from terminal sales, but also from software licence fees and terminal maintenance. Araxi owns the software that facilitates terminal payments, via the Bankserv national payments system. Terminals in the hands of banking clients increased by 15% to 446k units, by September 2025. It also has a software division that provides sophisticated software solutions to financial institutions. This division generates revenue mainly from consulting fees. It also earns software licence fees selling its own, and third party, software to its clients. It is well positioned to benefit from increasing AI application investment, by corporate clients.

Halo-Dot:

NFC, which is short for near-field communication, is a technology that allows devices like phones and smartwatches to exchange small bits of data with other devices and read NFC-equipped cards over relatively short distances. Using a phone or a watch to tap a point-of-sale terminal has become commonplace. Araxi has developed software that allows NFC phones to be used as a secure point-of-sale terminals. This software is unique in its communication robustness; less communication breaks results in less missed sales for customers. This development has enormous potential for informal merchants around the world. Halo-Dot is gaining strong momentum with enterprise customers, in the USA, Mexico, Brazil, UK, Netherlands, South Africa, Turkey, and Singapore. Halo-Dot also has a tap-on-own-device application. Tapping one’s card on an own device reduces merchant fraud materially, converting high-risk card not present online payments, to card present payments. This reduces transaction fees by shifting fraud liability from merchants to card issuers.

Recent Results:

Results for the 6 months to September 2025 were impacted by several once-off accounting adjustments. On a normalised basis, revenue increased by 9.2% to R661m. Normalised EBITDA increased by 44%. Normalised Headline Earnings per Share increased by 58%. Net cash and cash equivalents amounted to R303m at half year end.

Holdings- Recent Results – October 2025

DRD Gold (DRD): 12% of the fund

DRD Gold is staggeringly profitable:

Low-Risk High-Return:

DRD produces 155k ounces of gold a year, at an All-In-Sustaining-Cost of $1716 per ounce. It produces all its gold from tailings retreatment. The risks in surface mining are relatively low. Actual and expected yields hardly differ. Lost time injuries are few. And the returns are high. The 30-year-old ERGO plant, which accounts for 70% of current production, is fully depreciated. It still operates efficiently and at full production. ERGO’s new solar energy plant has reduced costs materially. At the current gold price, and expected FY26 production volumes and costs, DRD will generate a 55% Return on Equity.

Vision 2028:

DRD plans to increase production by 33% (to 200k ounces per annum) over the next 3 years, at a total capex cost of R7.8bn. At ERGO this involves expanding the Daggafontein Tailings Storage Facility (TSF) and developing a new TSF at Withoek, near Brakpan. On completion of the Daggafontein expansion and successful permitting of Withoek, DRD can start processing the high-grade Crown Tailings Complex, situated between Marshalltown and Soweto. This deposit contains an estimated 64 tonnes of gold and will release 800 hectares of prime property for sale. At the Far West Rand Gold Recovery operations, the Driefontein Plant capacity will be doubled, on the completion of the new Regional Tailings Storage Facility.

Recent Results:

Results for the 12 months to June 2025 were exceptional. These were driven by a 31% increase in average gold price received. Revenue increased by 26% to R7.9bn. Operating Profit increased by 69% to R3.5bn. Headline Earnings per Share increased by 69% to 260.6 cps. Dividends declared increased by 75% to 70cps. DRD ended the year with R1.306bn in cash and cash equivalents, after spending R2.25bn on the expansion project.

Holdings- Recent Results – September 2025

Pan African Resources (PAN): 14% of the fund

Pan African Resources has been a fantastic investment for the fund:

Low-Risk High-Return:

With the successfully ramp-up its two new tailings operations, MTR and Tennant Mines, Pan African Resources (PAN) will produce 60% of its production, from tailings retreatment. Tailings retreatment (compared to deep-level mining) is a low-risk, high-return, business. PAN’s tailings operations had zero lost time and reportable injuries in 2025. As surface deposits are easy to measure there is little difference between expected yields and actual yields, which reduces production risk. Tailings retreatment is a high return business as it requires lower levels of capital investment. No expensive haulage, cooling and pumping systems are required.

Increasing Production and Declining Costs:

PAN produced 197k ounces of gold during FY2025, at an All-In-Sustaining-Cost (AISC) of $1600 per ounce. In the year to June 2026, it plans to increase production by 40% (to between 275k and 292k ounces). AISC is expected to decrease by 3% to $1550 per ounce. (The global industry average AISC is $1722 per ounce). Increased production at a lower cost will be achieved through increasing plant capacity at MTR, and mining higher grade deposits at Evander and the Tennant open pit mine.

Recent Results:

Results for the 12 months to June 2025 were extraordinary. At an average gold price of $2735 per ounce received, revenue increased by 45% to $540m. Profit Before Tax increased by 78% to a record $141m. Earnings per Share increased by 73% to US 7.16cps. PAN will have zero debt by June 2026 and has authorised $11m in share repurchases.

Holdings- Recent Results – August 2025

Weaver Fintech (WVR): 4.4% of the fund

Weaver Fintech’s Pay Just Now, is the largest Buy-Now-Pay-Later service provider in South Africa. It is growing rapidly:

Network Effects:

Buy-Now-Pay-Later (BNPL) is a beneficial transaction between three parties, a client, a merchant, and a BNPL service provider. The service provider provides an interest free loan to a client, at the point of sale. The merchant pays a fee to the service provider to cover the cost of the loan. The merchant gains a credit sale with no credit risk. The client can cost-effectively manage their cash flow between paydays. The service provider conducts a real-time credit check at the point of sale and ensures collection. It also provides value added client data to the merchant. Weaver Fintech now has 2.4m BNPL clients and 3100 merchants on their platform. (Merchants include Superbalist, Edgars, Makro, and Cape Union Mart). Loans are typically repaid over three instalments, one at point of sale, and the remaining two over the following two months. Merchant fees are usually 7% of the value of the transaction. Weaver benefits from powerful network effects. As they acquire more customers merchants gain greater sales opportunities. An expanding merchant network increases choice for customers, while merchants benefit from personalised solutions and engagement, with a growing pool of active users. The value of transactions funded is growing at an exponential rate. Weaver’s Gross Merchant Value increased 87% for the 6 months to June 2025 and has increased from zero to R9bn pa over the last 5 years. Weaver has 8 additional fintech products, including a mobile wallet and funeral insurance, that it cross-sells into its BNPL client base.

Scale Economies:

Weaver benefits from powerful scale economies, which drive profitability. It now has 3.5m group customers, a 4x increase in 5 years. As a result, customer service costs per transaction have declined from R6.73 per transaction in 2023, to R3.92 per transaction. Revenue per employee has increased from R1.6m in 2023, to R2.5m.

Recent Results:

Results for the 6 months to June 2025 were driven by the exceptional growth in the BNPL business. Revenue increased by 29% to R2.6bn. Profit Before Tax increased by 48% to R370m. HEPS increased by 45% to 285.5 cps. Interim Dividends increased by 47% to 140 cps. Leverage remains conservative, with Net Debt to Equity at 83.2%.

Holdings- Recent Results – July 2025

Capital Appreciation (CTA): 4.4% of the fund

Capital Appreciation is an exciting payments and software business. It is growing rapidly and trades on an attractive 10x historic earnings, and a 7% dividend yield. Capital Appreciation dominates the payments terminal (credit-card machine) market in South Africa. It benefits from powerful scale economies:

Payments:

Cash is becoming redundant. By 2027, an anticipated 70% of all payments in South Africa will be digital. A significant expansion in payment infrastructure is expected. Two companies within Capital Appreciation’s payments division, African Resonance and Dashpay are the leading importers and distributors of payment terminals. They also provide the software interface between payment terminals and Bankserv, the national payments system. Halo Dot is a proprietary software solution provider that allows any near-field-communication enabled device, to accept payments. Apple and Android smart phones can now be used as payment terminals using the Halo Dot application. This will transform how micro-enterprises process payments in the future. Most of the payments division’s revenue (72%) is derived from terminal sales and maintenance support services. The remaining portion comes from transaction related income, and terminal rental income. The payments division is growing rapidly. In the year to March 2025 the terminal estate increased by 18%, to 424k devices. As the estate increases, unit cost declines, providing a powerful competitive advantage. Terminal sales increased by 41%, terminal rental income increased by 15%, and transaction related income increased by 19%. Annuity revenue makes up 53% of total revenue.

Software:

Synthesis is a highly specialised software and systems developer. It offers consulting and innovative software solutions, and technology-based products. Synthesis is an Amazon Web Services (AWS) Premier Teir Partner. (It has assisted several banks move their operations into the AWS cloud). For the year ended March 2025 revenue declined by 8% and EBITDA decreased by 32% as the division was overstaffed in anticipation of winning a large new contract. This failed to materialise. The staff compliment has been adjusted, and profitability is expected to recover. The division is well placed to help customers benefit from Artificial Intelligence (AI) applications, as companies look to enhance productivity and scale, using AI.

Recent Results:

Results for the 12 months to March 2025 were driven by the exceptional performance of the payments division. Revenue increased by 8% to R1.25bn. EBITDA increased by 23% to R334m. HEPS increased by 26% to 17.6 cps. Dividends increased by 20% to 12 cps, and R42m of shares were repurchased. Net cash, and cash equivalents, at year end amounted to R402m.

Holdings- Recent Results – June 2025

Tharisa (THA): 7% of the fund

Tharisa produces 140k ounces of Platinum Group Metals (PGM) and 1.65m tonnes of chrome concentrate per annum. It currently has one open-cast mine near Rustenburg. The Karo Project in Zimbabwe will more than double PGM production.

Platinum prices are surging:

At $1380 per ounce, the platinum price is the highest it has been in 10 years. According to the World Platinum Investment Council, the platinum market will be in a “substantial and consecutive supply deficit at least until 2029”. Tharisa is well placed to benefit.

Karo Project:

The Karo Project is a game changer for Tharisa. It is one of only two greenfield PGM projects in the world. Zimbabwe hosts the second largest PGM resource globally, with 3 operating mines (Impala, Valterra and Sibanya) successfully producing 1,145m oz per annum. Karo owns one of the best PGM resources. It consists of 12m shallow (low-cost) ounces of contained PGM, and a total resource of 96m ounces, with more than 50 years of expected life of mine. Tharisa currently owns 85% of Karo, with the Zimbabwe government owning 15%. Tharisa has invested $100m, and expects to produce 226k PGM ounces per annum, 15 months after financial close. This should occur by September this year, with a $300m final funding round, when third-party equity and debt is raised. The project is fully licensed with water, electricity and road infrastructure secured. Open-cast design, engineering and earthworks are complete. Civils, procurement, and fabrication are almost complete. A mining contractor has been appointed.

Recent Results:

Results for the 6 months to March 2025 were impacted by lower PGM prices, and abnormal high rainfall. Revenue decreased by 24% to $281m. EBITDA decreased by 45% to $44m. HEPS decreased by 78% to 2.9 us cps. Interim dividends were maintained at 1.5 US cps, and a new share repurchase program for $5m was approved. Much improved results are expected in the second half.

Holdings- Recent Results – May 2025

Lewis Group (LEW): 5% of the fund

Lewis is a furniture retailer. It imports most of its products and sells mainly on credit. With 918 stores, it is one of two dominant furniture retailers in South Africa. Lewis generates a 15.4% Return on Equity, and trades on a 9.6% dividend yield:

Credit Sales:

In an increasingly digital world, credit furniture sales are becoming extremely profitable. With real-time access to the credit history of all credit active consumers in South Africa, better credit extension decisions can be made. Similarly, with better dialling engine and call centre technology, collection activity has become increasingly efficient. This is evidenced by a steadily improving gross debtor performance. In FY2021 satisfactory paid accounts was at 74.4% of gross debtors. In FY2025 this figure is now a record 83.5%. In the current year, the debtors book grew by 14.5%, in line with revenue, but debtors’ costs amazingly decreased by 2.6%.

Recent Results:

Results for the 12 months to March 2025 were exceptional. Revenue increased by 13.5% to R9.3bn. HEPS increased by 60% to 1483cps. Dividends increased by 60% to 800cps. Lewis has repurchased almost 50% of its shares in issue since listing in 2004.

Holdings- Recent Results – April 2025

Hudaco (HDC): 6% of the fund

Hudcao imports and distributes a wide range of high-quality branded automotive, industrial, and electronic consumer products:

Hudaco has consistently generated a high return on equity (currently 15.4%) through high margins and a low capital base. High margins are maintained by adding value to its customers. It does this through readily available stock, as well as technical advice and training.

Growth through Acquisition:

Despite a stagnant economy, Hudaco has historically grown earnings through small bolt-on, earnings-accretive, acquisitions. These are typically funded with debt and are paid for over three years, through an earnout mechanism. Hudaco has a track record of acquiring at a reasonable price and seamlessly integrating companies into the group, post-acquisition. In the prior year Cadac was acquired. This has contributed meaningfully to earnings. In the current year Brigit Fire and Plasti-Weld were successfully acquired and integrated. Isotec, the largest acquisition to date, is in the process of being acquired. As a result of it broadly diversified portfolio of businesses, Hudaco is extremely well positioned for an anticipated increase in economic activity.

Recent Results:

Results for the 12 months to November 2024 were impacted by the national elections and port congestion. Revenue decreased by 5.8% to R8.4bn. HEPS decreased by 6.7% to 2012cps. Dividends were maintained at 1025cps.

Holdings- Recent Results – March 2025

Homechoice International (HIL): 3.1% of the fund

Homechoice is an outstanding fintech business. In 5 years, it has gown earnings per share at a 25% compound annual growth rate. Its Buy Now Pay Later (BNPL) business is growing exponentially. Gross Merchandise Value has increased by 19.5x in the last 6 years, a 100k new customers a month are signing up. It is now the largest BNPL service provider in South Africa.

Network Effects and Scale Economies:

Homechoice has created a digital platform that connects 2.7 million smart-phone borrowers, with 2800 retail merchants. Through its legacy mail-order catalogue business, Homechoice has curated a specific unsecured lending niche. Its average digital-savvy customer is a 37-year-old, black, urban, female, who has a low credit-risk score. A staggering 85% of customers are repeat customers. Pay Just Now, Homechoice’s BNPL service provider, has signed up 2800 retail merchants who can now provide free credit to their customers. Merchants pay an average 6% of the credit extended as a merchant fee. Pay Just Now then disburses and collects the credit, after an instore credit application is performed, by the customer on their mobile phone. The customer pays a third of the purchase price upfront, and then the remaining balance over two monthly instalments. Once a customer is on the platform, Homechoice can cross-sell additional products, such as funeral insurance and a digital wallet. Digital analytics are sold to the merchant. This provides powerful network effects that benefit the customer, the merchant and Homechoice. As more customers and digital products are added to the network, Homechoice benefits from powerful scale economies. In 5 years, annual revenue per employee has increased from R2m to R5m.

Recent Results:

Results for the 12 months to December 2024 were spectacular. Revenue increased by 20.6%, driven by a strong 38.7% increase in fee income, (largely insurance premiums and merchant fees). Debtor’s costs increased slightly more than revenue, but the quality of the loan book remained robust with constant credit loss ratios, despite strong growth over the last 3 years. Profit after tax increased by 25.7%. HEPS increased by 27.3% to 394 cps. Dividends increased by 17% to 97cps

Holdings- Recent Results – February 2025

The gold price is close to a record high:

The fund has invested in two gold mining companies. These companies produce gold, primarily through a mine-waste (tailings) retreatment process. This is a relatively low-risk, high-return, business model. At current operating margins, these companies are staggeringly profitable:

Pan African Resources (PAN): 13% of the fund

Pan African will produce 60% of its 315k ounce annual gold production from tailings retreatment, within the next 12 months.

Pan African plans to increase gold production by 57% in the next year. The new Mogale Tailings Retreatment (MTR) operations have now fully ramped up to 50k ounces of annual production, at an All In Sustaining Cost (AISC) of $950 per ounce. The adjacent Soweto Cluster of tailings deposits will soon add another 10k ounces to annual production and extend the life of the MTR operation to 21 years. Pan African is negotiating with Sibanye Stillwater to acquire several dormant tailings deposits in the area. These would add to annual production at little incremental cost. The Tennant Creek Mining Group tailings operation, in Australia, goes into production within the next few months. This will add a further 55k ounces to annual production at an AISC of $1 300 per ounce for an initial 6 years, with a less than 3-year payback period. There is significant exploration potential, with a mineral resource of 1.3m ounces.

Recent Results:

Results for the 6 months to December 2024 were impacted by lower production and a costly gold hedge, mitigated by a higher gold price. Revenue decreased by 1% to $189m. Profit after tax increased by 10%. Earnings per share increased by 10.3% to 2.35 US cps. Lower production stemmed from ESCOM transformer issues and shaft upgrade delays. These have now been resolved. Happily, the gold hedge (a requirement of the MTR project financing facility) has been closed, and near-term expansion capex is largely complete. Future dividends, and share re-purchases, are expected to increase significantly.

DRD Gold (DRD): 11% of the fund

DRD produces all its 165k ounce annual production, from tailings retreatment.

Volume Growth:

DRD plans to increase gold production by 33% by June 2028. This will be achieved through the recommissioning of the Withoek Tailings Storage Facility at ERGO, and the completion of the massive deposition Regional Tailings Storage Facility, and doubling of Driefontein 2 plant capacity, at the Far West Gold Recoveries. DRD expects to play a consolidation role in the Far West Rand, on completion of the new storage facility, through the acquisition of dormant tailings deposits.

Recent Results:

Results for the 6 months to December 2024 were spectacular. Revenue increased by 28% to R3.8bn. Operating profit increased by 74%. HEPS increased by 65% to 112.2 cps. Interim dividends were increased by 50% to 30cps.

Holdings- Recent Results – January 2025

Hosken Consolidated Investments (HCI): 9.6% of the fund

Unlocking the hidden value within Africa Energy and Impact Oil and Gas:

Africa Energy is a USA listed oil and gas exploration company. In 2013 it formed a joint venture to explore Block 11B/12B, an 18 000 km2 area, 175 km south of Mossel Bay. HCI owned a small stake in Africa Energy through Impact Oil and Gas. In 2019 after incurring more than $400m in exploration and drilling costs, the joint venture announced they had made two significant gas condensate discoveries. They named these Brulpadda and Luiperd. A plan was developed to sell the gas to PetroSA. This would replace the depleted feedstock for their 45 000 barrel a day gas to liquid plant in Mossel Bay. In addition, a 2 300MW gas to power plant was planned. This would replace all of Eskom’s diesel generators.

In July 2024 Africa Energy’s partners in the joint venture (TotalEnergies, Qatar Energy and Canadian Natural Resources) decided to abandon their

interests. This was due to the project’s inability to sign an offtake agreement with PetroSA and the SA government. This left Africa Energy with 75% of the project. (The other 25% shareholder being a BEE entity controlled by former MTN CEO Phutuma Nhleko). Africa Energy’s plan was to secure an offtake agreement, then farm-out the project to an oil-major to develop the gas infrastructure.

In December, an interesting development occurred. HCI quietly increased its stake in Africa Energy. It now has a 60% controlling interest, held through a company that also holds Impact Oil and Gas. (Impact owns a 9.5% interest in the giant Venus discovery). It suggests Africa Energy has made progress in securing an offtake agreement. It also suggests HCI intends to reverse its holding in Impact into the listed Africa Energy, then unbundle the combined entity to HCI shareholders, as it did with Montauk. As the market subscribes little value to the oil and gas assets within HCI, this should unlock significant value for shareholders.

Holdings- Recent Results – December 2024

Information Security Architects (ISA): 3% of the fund

ISA generates a 44% Return on Equity. It pays out all its earnings as dividends.

ISA has been a great investment for the fund. The fund’s original purchase has been more than covered by dividends received, and the share price has tripled.

Cyber Security:

ISA provides a Managed Cyber Security Service to blue-chip customers, who pay monthly subscriptions. MSS Pulse is an internally developed cyber security infrastructure management, monitoring, and reporting platform, that helps secure clients’ IT systems from cyberattack. Subscription revenue accounts for 86% of total revenue, the difference is derived from distributing Fortinet and Palo Alto cyber security products. Demand for cyber security products and services has robust growth potential. Clients’ IT systems are under persistent and increasing attack, and regulatory and legislative compliance requirements are also increasing.

Recent Results:

Earnings for the 6 months to August 2024 were driven by lower revenue but higher gross margins. Revenue decreased by 8% as a few large product sales in the prior period did not reoccur. Gross profit increased by 8% as margins increased to 55%, on increased contribution from higher margin managed services. Headline earnings per share increased by 10%.

Holdings- Recent Results – November 2024

Lewis Group (LEW): 3.7% of the fund

Lewis has repurchased 48% of its shares in issue. Over the last 10 years, it acquired shares at an average 49% discount to Net Asset Value. It has created significant shareholder value in the process.

Store Expansion:

Lewis sells furniture, appliances, and electronics, mainly on credit. Other revenue (finance charges and insurance premium) makes up 46% of total revenue. It has 897 retail stores, mainly in South Africa. It operates under the following brands: Lewis, Best Home and Electric, Bears, Bedzone, Real Beds and UFO Furniture. Through store expansion, Lewis is increasing market share. In the last 6 months Lewis opened 15 new stores and acquired 13 more, in the acquisition of Real Beds.

Lower Interest Rates- Improving Consumer Demand:

Consumer credit conditions are improving. Lower anticipated interest rates increasing affordability, lower transport and food prices on a stronger currency, and the suspension of load shedding are adding to improved consumer sentiment. Lewis is well positioned to benefit.

Recent Results:

Earnings for the 6 months to September 2024 were spectacular. Revenue increased by 13,6% to R4.4bn. Operating profit increased by 54.1%, (margins increased to 20.2% from 14.2%). The debtors book grew 16.9% and satisfactory paid account were a healthy 81.6% of the total debtor book, (debtor costs as a % of total debtors remained constant at 7%). The gearing ratio increased to 46% of equity, as inventory levels increased in anticipation of peak Christmas sales. Return on equity was 12%. Headline earnings per share increased 49% to 555cps. Interim dividends per share increased 50% to 300cps.

Holdings- Recent Results – October 2024

Jubilee Metals (JBL): 3.5% of the fund

Jubilee Metals is an exciting tailings processor, ramping up copper and chrome concentrate volumes:

Zambian Copper:

Happily, in September 2024, a new Private Power Purchasing Agreement was signed. (Jubilee had suffered from erratic hydro-electric power supply, due to a drought). This game changing agreement now supplies uninterrupted power to all of Jubilee’s operation in Zambia. Jubilee is currently on track to produce 1800 tonnes of copper for the 6 months to December 2024, and 6 000 tonnes for the full financial year to June 2025. This will be ramped up to over 13 000 tonnes per annum by June 2026. Copper earnings are expected to increase materially. At the current copper margin of $2670, 6 000 and 13 000 tonnes of copper production will generate $16m, and $35m per annum, respectively, in Earnings Before Interest Tax Depreciation and Amortisation (EBITDA). Copper margins should also increase as volumes increase, and more (high value) cathode, compared to concentrate, is produced.

South African Chrome Concentrate:

Jubilee is one of the world’s largest chrome-concentrate producers. It is on track to produce a record 1.65 million tonnes to June 2025. As a byproduct of its chrome operations, it will produce 36 000 ounces of Platinum Group Metals (PGM). Jubilee plans to ramp up production to 2 million tonnes of chrome concentrate and 42 000 ounces of PGM, in the financial year to June 2026. Chrome margins should increase as less third-party feedstock is used.

Recent Results:

Earnings for the 12 months to June 2024 were impacted by a decline in PGM prices and volumes. Revenue increased by 20% to $205m. EBITDA of $28m declined 7%. Non-current liabilities declined 3% to $22m.

Holdings- Recent Results – September 2024

Pan African Resources (PAN): 11.5% of the fund

Pan African Resources has been a fantastic investment for the fund:

Mogale Tailings Retreatment (MTR) Project:

The MTR project will start producing 50k ounces of gold per annum in December, increasing total production by 25%. This high return, low risk tailings retreatment project will produce gold at an All-In-Sustaining-Cost (AISC) of $900 per ounce. (This is materially below the industry average AISC of $1414 per ounce). At the current hedged gold price, the R2.5bn construction capex will be repaid in less then 2.5 years. The project has a 13-year life of mine, with plans to increase production to 60k ounces per annum, over 21 years.

Declining Capex, Increasing Free Cash Flow and Dividends:

As the MTR and the Evander number 7 Shaft projects are nearing completion, future expansion capex is expected to decline significantly. On increased production, free cash flow generation, debt repayment and dividends should increase materially. Return on Equity of 24%, is expected to increase to over 30% in the coming year.

Recent Results:

Earnings for the 12 months to June 2024 were driven by a 5% growth in volume sold, and a 11% increase in gold price received. Revenue increased by 17% to $374m. attributable earnings increased by 30%, and headline earnings per share increased by 32%. Dividends per share increased by 22%.

Holdings- Recent Results – August 2024

Homechoice International (HIL): 2.6% of the fund

Homechoice is an exciting Fintech business:

Weaver Fintech:

Weaver provides short-term unsecured loans, through a smart phone app, it then cross-sells funeral insurance, and a mobile wallet, to existing customers. Weaver has a clearly defined target market. It has 1.8m digitally enabled customers, which accounts for 12% of its total addressable market. (The average customer earns R15 700 per month and is 37 years old, 71% are female and 79% are responsible payers). Its Finchoice brand is trusted by its customers, as evidenced by an 85% repeat customer rate. Weaver’s digital platform drives customer adoption, and automation delivers efficiencies. There has been a 10x growth in customers in the last 5 years. It takes 1 minute to originate a loan to an existing customer, and 5 minutes for a new customer. Direct cost per digital transaction has reduced from R490, to R158 over the past 5 years.

PayJustNow:

Buy-Now-Pay-Later (BNPL) is an innovative service that benefits both merchants, and their customers. PayJustNow is the largest BNPL service provider in South Africa, with 2400 merchants signed up. These merchants can now provide interest free credit to their customers. Customers typically pay a third of the purchase price up front, and the balance over two monthly instalments. PayJustNow provides funding and collection, and underwrites the credit risk, (after conducting a real-time instore credit check). PayJustNow charges the merchant a transaction fee for BNPL services provided. Gross merchant value has grown 12x to R2.4bn, in the last 4 years.

Retail:

The legacy retail business now contributes only 5% to operating profit. With the demise of the post office, its mail order catalogue business has suffered. It now has a multi-channel distribution model which involves a call centre, digital marketing, and physical showrooms. With renewed focus on bedding products and better credit extension, together with increasing showroom roll-out, the retail business should start to contribute to earnings growth.

Recent Results:

Results for the 6 months to June 2024 were driven by a 17% increase in digital loan disbursements, 174% increase in BNPL gross merchant value, and a 25% increase in funeral insurance premiums. Revenue increased by 14.6% to R2bn. Credit loss ratios were maintained despite the constrained consumer environment. (The wholesale funding market remains supportive, with significant covenant headroom remaining). Profit after tax increased 35%. Earning per share increased 38% to 197cps, and the interim dividend was increased by 36% to 95cps.

Holdings- Recent Results – July 2024

Hosken Consolidated Investments (HCI): 11.9% of the fund

The fund’s investment in HCI has doubled in value. There is a good chance it will double again in the next three years.

Impact Oil and Gas:

HCI owns 49.9% of Impact Oil and Gas. Impact owns 9.5% of two offshore oil and gas exploration blocks, in the Namibian Orange River Basin. Impact’s partner, TotalEnergies, has drilled four exploration wells. According to HCI’s management, these blocks are likely to produce “several billion barrels of oil, and trillion cubic feet of gas, over time”.

- Farmout Agreement: Impact has entered into an agreement with Total, which de-risks Impact’s funding liability. (The agreement has been signed but still needs the approval of the Namibian government). In exchange for an additional share in the blocks, Total will provide Impact with an uncapped carry loan covering all future development, appraisal, and exploration costs. It also provides for a payment of $99m as a reimbursement for past costs. The loan is repayable from JV cashflow after first-oil is produced. Determining the full extent of the recoverable oil and gas is an ongoing project, that will take a few years. Total’s development plan is still to be announced, but first-oil is expected somewhere around 2030.

- Valuation: The market currently places little value on Impact’s potential. However, a rough estimate can be made with reference to the number of Floating Production Storage and Offloading (FPSO) platforms the development plan envisages. Depending on flowrate, oil price, first-oil date, and discount rate assumptions, each FPSO could be worth a $1bn of Net Present Value to Impact. This equates to R100 per HCI share.

- Additional Exploration Assets: Impact owns a 22% interest in the Orange Basin Deep License covering 14k square km off the coast of South Africa, immediately south of the existing Namibian discoveries. It also owns 45% interest in a 124k square km license, off the Transkei coast.

Recent Results:

Results for the 12 months to March 2024 were underpinned by strong earnings growth from Southern Sun. Net asset carrying value per share increased by 5% to R235 per share. EBITDA increased by 7%. Headline earnings per share declined by 29% after a fair value impairment on a casino license.

Holdings- Recent Results – June 2024

Argent Industrial (ART): 4.5% of the fund

Argent has been a fantastic investment for the fund.

It generates a 14.2% Return on Equity (with 7% gearing), and trades on 5x earnings and a 5% dividend yield.

Shareholder Value:

With the help of an activist investor, Argent has created significant shareholder value. It has sold non-core assets in South Africa, repurchased a significant amount of shares, and invested in high return businesses in the United Kingdom. (Half of revenue, and 63% of Profit Before Tax, is now earned from outside of South Africa, mainly in the UK and USA).

Increasing Offshore Exposure:

Argent’s strategy is to wind down its South African steel and aluminium trading companies, Phoenix Steel and Gammid. The capital released will be invested in its UK distribution platform, for the local manufacturing operations. These businesses include well-known brands such as Jetmaster, Xpanda, American Shutters and Castor & Ladder. Additional working capital investments will be made to grow the UK specialist manufacturing operations– Fuel Proof manufactures fuel storage solutions. Fluid Transfer International and Flofuel manufactures mobile fuel dispensing systems for the international aviation industry, as well as the maritime and oil distribution industry. OSA Door Parts manufacturers a range of industrial doors. Partington supplies retail material handling solutions and Cannock Gates supplies iron and wooden gate products for the consumer market. The USA operation, New Joules Engineering which manufactures speed control retarder systems for rail yards.

Recent Results:

Results for the 12 months to March 2024 were driven by increasing contributions from offshore revenue, and export sales. Revenue increased by 4%, HEPS increased by 7% to 438.5cps. (Earnings were tempered by the increase in the UK corporate tax rate, from 19% to 24%). A total dividend of 115cps was declared, and the share repurchase program will continue into the new year.

Holdings- Recent Results – May 2024

Afrimat (AFT): 7.9% of the fund

- Afrimat has a history of buying distressed businesses, and turning them around quickly

- It has recently acquired Lafarge’s distressed construction materials business. It plans to turn it around quickly

Afrimat is primarily a bulk commodities miner, producing iron ore and anthracite. It also has construction materials, industrial metals and phosphate operations. Afrimat generates an impressive 25.6% Return on Net Operating Assets, with virtually no debt.

Lafarge Acquisition:

Lafarge’s South African operations were acquired for $6m, and R900m in repayment of loan accounts:

- The business is loss making. Management believe it can be quickly turned around, through some innovation, and enhanced operational efficiencies.

- The acquisition adds significant new capacity to Afrimat’s existing aggregates quarries and ready-mix operations. It now provides a national footprint with well-located quarries. It provides entry into the fly-ash/cement extender market. A grinding plant allows for various new value-added products, and the cement kilns provide entry into the cement market, with state-of-the-art equipment.

- The timing of this transaction is opportune. The construction materials business in SA is experiencing increased activity. Railway and road maintenance being key drivers of increased demand.

Recent Results:

Results for the 12 months to February 2024 were driven by higher bulk commodity volumes. Revenue increased by 24% to R6.1bn. HEPS increased by 24% to 567.3cps. Operating Profit margins decreased from 19.6% to 18.9% due to a poor performance from the industrial metals (lime) business.

Holdings- Recent Results – April 2024

AECI (AFE): 3.9% of the fund

AECI is a global mining explosives business. It is in a restructuring process, which aims to double profits, within 18 months.

Restructuring:

AECI’s new management team plans to sell its non-core businesses. Disposals include Schirm (a German Agri-chemicals business) and Much Asphalt. These are recent acquisitions that have materially under-performed. It plans to grow the mining explosives business by focussing on the Asia-Pacific region, expansion of existing operations in Latin America, and entry into North America. It has initiated plans to reduce dependency on South African produced ammonia, through import substitution. Although the chemicals business is dependent on SA GDP growth, profitability will be enhanced through focus on cost reduction, and improving efficiencies.

Recent Results:

Results for the 12 months to December 2023 were impacted by higher finance costs. Revenue increased by 5% to R37.5bn. EBITDA increased by 3% to R3.7bn. HEPS decreased by 12%, on a 63% increase in finance costs. By 2026, management plan to increase EBITDA to more than R6bn, and increase Return On Invested Capital (ROIC) from 11.2% to above 19%. They aim to maintain the gearing ration at the current 35%. Non-core sales proceeds will be returned to shareholders through buy-backs, and/or used for acquisitions to enhance the core growth strategy.

Holdings- Recent Results – March 2024

Jubilee Metals (JBL): 5.7% of the fund

Jubilee Metals is a tailings processor that is well positioned to benefit from higher chrome-concentrate, and copper prices:

Chrome Concentrate:

Jubilee has a high return, low risk business model. It processes third-party chrome tailings on a fixed margin, to produce chrome-concentrate. The chrome-concentrate tailings are then re-processed to recover Platinum Group Metals. These are sold in the spot market, at high margins. Jubilee has developed an innovative modular processing technology. This uses modern milling and measuring methods, which allow for efficient extraction. Modular plants (that can process multiple types of chrome feedstock), allow for the rapid ramp up of production volumes. Within 5 years, Jubilee has become one of the world’s largest chrome concentrate producers. It currently produces 1.45mt per annum, with plans to produce 2mt pa by 2025. Jubilee has recently shifted its model to partly producing chrome concentrate and PGM, from its own feedstock. As volumes ramp up to 2mt pa, margins should increase materially.

Copper:

Jubilee is using the same modular processing technology to produce copper from tailings, in Zambia. It has invested ~$100m in plant and smelting capacity, and currently produces 5 800 tonnes pa, at a cost of $4 554 per tonne. It is in the process of ramping up production to 13 000 tonnes pa. Jubilee has recently entered into a partnership with Abu Dhabi’s International Resource Holding (IRH) to develop a Zambian waste rock project. IRH was the successful bidder for the giant Mopani Copper Mine. The waste rock project plans to produce 24 000 tonnes of copper units pa, at a cost below $4 000 per tonne. The project is in the due-diligence phase, and is subject to a $50m investment from IRH. The waste rock resource contains 260m tonnes of waste material at Mopani, with copper grades over 1.5%. Jubilee has also entered into a joint venture agreement with Mopani to develop all historical slag waste from the Mufulira smelter operations. This project is currently in technical review.

Recent Results:

Results for the 6 months to December 2023 were driven by higher chrome and copper prices, as well as volumes, but tempered by lower PGM prices. Revenue increased by 18% to GBP75m. EBITDA increased by 14%. Profit after Tax increased by 7.3%. Earnings per Share increased by 7% to 0.16 pence per share.

Holdings- Recent Results – February 2024

Pan African Resources (PAN): 10% of the fund

Pan African Resources (PAN) generates at 20% return on equity, and trades on a 4% dividend yield.

Once the Mintails retreatment project is operational, PAN will be generating 40% of its gold production from tailings. It also has high-grade, long-life underground operations, at Barberton and Evander, that benefit from legacy infrastructure investment, acquired at attractive valuations. PAN is ramping up production volumes, and will benefit from 80MW of solar energy investment:

- Volume Growth: PAN currently produces 180k ounces of gold per year. This will increase to more than 230k ounces per annum by June 2025. Mintails, located on the west Rand, will add the bulk of the additional ounces, with 50k ounce per annum production, commencing in December 2024. Mintails has a planned 20 year life, 3.5 year pay-back period, and an All-In-Sustaining-Cost (AISC) of $914 per ounce. The R2.5bn project is on time and within budget, and demonstrates how profitable tailings retreatment can be.

- Renewable Energy- Cost Reduction: PAN currently generates 9.5% of its electricity needs with 28.6MW of installed solar PV panels. By 2027 it will generate 40% of its needs, with 80MW solar PV. This will not only provide more reliable power, but will also generate a cost saving of over R200m per year.

Recent Results:

Results for the 6 months to December 2023 were much improved. Gold production increased by 7% to 98k ounces, and AISC decreased by 0.3% to $1287per ounce. Revenue increased by 24% to $194m. EBITDA increased by 41%. HEPS increased by 46% to 2.22 US cps. Annualised EBITDA covers Net Debt of $64m, by 2.3 times.

DRD Gold (DRD): 7% of the fund

DRD Gold (DRD) generates at 19% return on equity, and trades on a 6% dividend yield.

DRD produces all of its 180k ounce annual gold production from tailings retreatment. It has two operations. ERGO on the east Rand, and FWGR on the west Rand. ERGO experienced production shortfalls during the period due to a number of once-off factors (water-use license delays, and community disruptions). These have now been resolved. FWGR experienced yield declines as production shifted from Driefontein 5, to Driefontein 3. Happily, significant medium-term volume growth is expected:

- Volume Growth: Phase 2 of the FWGR Driefontein 2 project has commenced. This doubles capacity of the plant, and increases the Regional Tailings Storage Faculty by 800mt. The Platinum Group Metals tailings JV with Sibanye Stillwater is in final approval stages. The results of a uranium project feasibility study will, hopefully, be announce at the year-end results presentation, in August 2024.

- Renewable Energy- Cost Reduction: ERGO has invested in a 14MW Solar Power Project, which will be fully commissioned next month. A 160MWpower storage facility will be functioning by October this year. These initiatives will account for all of ERGO’s power needs, and result in an estimated cost saving of R9 per ton of tailings processed. This equates to R140m per annum.

Recent Results:

Results for the 6 months to December 2023 were driven by a 22% increase in average gold price received. Gold production decreased by 7% to 90kounces, and AISC increased by 10% to $1575 per ounce. Revenue increased by 12% to R2.974bn. Group Operating Profit increased by 15%. HEPS increased by 10% to 68.4cps. DRD has R1.5bn cash on hand, with R3bn near-term capex plans.

Holdings- Recent Results – January 2024

Hudaco (HDC): 6.3% of the fund

Hudaco is a value added distributor of imported industrial products. It generates a 20% return on equity, and trades on a 6%dividend yield.

Its businesses fall into two primary categories:

- Consumer: Supplies products focused on the automotive aftermarket, power tool and fasteners, data networking, gas and outdoor, security and communication, and battery and sustainable energy markets.

- Engineering consumables: Supplies products focused on bearings and belting, electrical power transmission, diesel engine, hydraulics and pneumatics, specialised steel, thermoplastic fittings, and filtration markets.

Sustainable Competitive Advantage:

Hudaco has a significant scale advantage over its competitors. Its large balance sheet, and wide branch network, allows for high stock availability and an extensive product range. The sale of replacement parts and products, with a high value-added component, leads to multiple repeat orders, and high margins.

Growth Through Acquisition:

Hudaco has an impressive track record of acquiring businesses cheaply, and integrating them well. During the past year Hudaco bought two businesses. In September it acquired Brigit Fire, an importer and distributor of fire detection, containment and suppression systems. In December it acquired Plasti-Weld, an importer and distributor of plastic welding equipment. These businesses were bought on low earnings multiples (with profit warranties), and have clear synergies and cost rationalisation opportunities identified. They should add materially to future earnings growth.

Recent Results:

Results for the 12 months to November 2023 were driven by growth in the engineering consumables business. (Supply of diesel engines, gear pumps, filtration, bearings and power transmissions, modular belting and electrical products were exceptional performers). Turnover increased by 9% to a record R8.9bn. Comparable earnings (after excluding a covid related insurance claim in the base) increased by 10%. Total dividends per share increased by 10%, after a R112m share repurchase. Hudaco has repurchased 10.3% of its issued shares over the last 4 years.

Holdings- Recent Results – December 2023

Hosken Consolidated Investments (HCI): 15.8% of the fund

HCI is an investment holding company. It owns a large portfolio of assets, the most interesting of which is Impact Oil and Gas:

Impact Oil and Gas:

Impact owns several deep water African oil and gas prospects. The Venus Project, located in the NamibianOrange Basin, has made a significant oil and gas discovery. On January 1st 2024 Impact entered into a Farmout Agreement with TotalEnergies. This is not the outright sale as expected, but it will create significant long-term value for HCI shareholders.

Venus Project- Farmout Agreement:

Impact has sold half of its stake in the Venus Project, and negotiated a free carry on all future exploration and development costs.

- The farmout agreement entails the sale of a 9.39% interest in Block 2912, and a 10.5% interest in Block 2913B. On completion of this transaction, Impact will hold a 9.5% interest in each block. Impact will also be reimbursed in cash for its share of the past costs incurred. This is estimated to be approximately USD 99 million. The agreement provides Impact with a carry loan for all of Impact’s remaining development, appraisal and exploration costs from January 2024 until the First Oil Date. The carry is repayable to TotalEnergies from Impact’s after-tax cash flow and net of all joint-venture costs, including capital expenditures, from production on the blocks, post the First Oil Date. During the repayment of the carry, Impact will pool its entitlement barrels with those of TotalEnergies for more regular off-takes, and a more stable cashflow profile. It will also benefit from TotalEnergies’ marketing and sales capabilities.

This agreement provides a low risk way for HCI to participate in a massive oil and gas project, for decades to come.

HCI Owns a Large Portfolio of Assets:

- Listed companies: Tsogo Sun Gaming (49.7%), Southern Sun Hotels (40.5%), eMedia Holdings (80.3%), Frontier Transport (82.2%), Deneb Investments (85.3%) and Platinum Group Metals (25.1%).

- Unlisted companies: HCI Coal (100%), HCI Properties (100%), Impact Oil and Gas (49.9%), Gripp Advisory (75%), BSG (40%), Alphawave (42.3%) and La Concorde (89.4%).

Recent Results:

For the six months to September 2023 income increased by 6%. EBITDA increased by 18% to R2.959bn. Hotel revenue increased by 34%, with much higher room rates and occupancy close to pre-covid levels. Gaming revenue increased by 7%. HCI’s stated Net Asset Carrying Value is R239.90 per share.

Holdings- Recent Results – November 2023

Reunert (RLO): 7.6% of the fund

Reunert generates at 17.4% Return on Equity, with no gearing. It trades on a 5.5% dividend yield.

Reunert is thriving. The electrical engineering, renewable energy and defence segments are doing particularly well:

Electrical Engineering:

Strong earnings growth in the power cable and circuit-breaker segment is being driven by investment in electrical infrastructure in South Africa and Zambia. Higher margins have been achieved through large cable contracts in SA, better product mix in Zambia, and scale efficiencies in manufacturing. Material investment into the transmission-grid to enable South Africa’s renewable energy aspirations is expected. Eskom is spinning out the national transmission grid into an independent company, as articulated in the Transmission Development Plan (TDP). This requires over 14 000km of new lines to enable the country’s 50GW renewable energy investment target. The TDP requires significant investment into Aluminium Conductor Steel Reinforced cable.

Renewable Energy:

Reunert imports and distributes a wide range of lithium-ion batteries. Continued loadshedding increased demand for residential and small commercial batteries. A record order book drove earnings in the Solar EPC business. A joint venture with AP Møller Capital has been created to enhance growth in the Build Operate and Own portfolio. There are now 87 plants in operation and work in progress. The large containerised battery manufacturing business is reaching full production, and should experience significant growth in the commercial and industrial market.

Defence:

Geopolitical tension has driven record demand for Reunert’s electronic artillery fuse, radar and encryption business. The successful integration of Etion Create, acquired in the previous period, has also contributed to record revenue and profit growth. Etion manufactures navigation equipment and displays for combat vehicles. Strong earnings growth is expected, driven by increased capacity in the fuse factory, easing supply-chain constraints and improved export permitting processes.

ICT:

This segment imports, distributes and finances office equipment. It also distributes air-time. It is customer base is experiencing severe headwinds, which has lead to flat earnings growth. Over the last few years Reunert has acquired a number of digital integration businesses in an effort to scale and diversify the segment. It’s latest acquisition, IQ Business, will contribute meaningfully in the near term, and should allow for the a separate listing of the ICT segment.

Recent Results:

For the 12 months to September 2023 revenue increased by 23%, operating profit increased by 28%. Headline earnings per share increased by 16% (after accounting for an increased provision for credit losses on the office equipment finance book). Free cash flow generation increased by 87%, as inventory levels normalised. The final dividend was increased by 11% to 332cps.

Holdings- Recent Results – October 2023

Textainer (TXT): 10.6% of the fund

Textainer is one of the world’s largest shipping-container lessors. It has been a fantastic investment for the fund.

Stonepeak Offers to acquire Textainer for $50 per share:

Stonepeak is a US based investment manager, which makes infrastructure investments, on behalf of pension fund clients. In October, Stonepeak entered into an agreement to acquire all of Textainer’s common shares, for $50.00 per share in cash. The transaction is expected to close in the first quarter of 2024, subject to customary closing conditions. These include approval by Textainer’s shareholders, and other required regulatory clearances and approvals. The agreement includes a 30-day “go shop” period, expiring on 22 November. This permits the company to solicit alternative bids, at a higher price.

Alternative Bid, or Revised Stonepeak Offer:

It is likely that a higher price will be received. Textainer’s stated book value as at 30 September 2023 is $48 per share. This prices Stonepeak’s $50 offer at a slight premium to book value. Triton International, an almost identical company, was acquired by a private equity buyer in April 2023, for a price to book multiple of 1.8x. This suggests that there could be material upside to the current offer.

Holdings- Recent Results – September 2023

Pan African Resources (PAN): 5.6% of the fund

Tailings retreatment is a relatively high return, low risk business:

Pan African Resources (PAN) is increasingly becoming a tailings retreatment business. Within the next 14 months PAN will produce 45% of its targeted 220 000 ounce (oz) annual gold production, from its tailings operations in Barberton, Evander and now at Mintails, west of Johannesburg. It will be one of the world’s lowest-cost gold producers, and should generate a return on equity in excess of 25%.

Mintails- Cash Machine:

In October 2022 PAN acquired the Mintails surface deposit, which contained 2m oz of gold, for a bargain $2.8m, or $1,33 per oz. Construction of the retreatment plant has commenced. It will cost R2.5bn, and will reach steady state production by December 2024. It is expected to produce 50k oz per annum at an all-in-sustaining-cost (AISC) of $914 per oz, for the 13 year life-of-mine. It should generate an un-leveraged 23% IRR on the current gold price, with an attractive 3.5 year payback period. The project has been fully financed, and has been partially hedged with a forward gold sale. A study is currently underway to assess the feasibility of extending the life-of-mine to 21 years.

Recent Results:

Results for the 12 months to June 2023 were impacted by lower production volumes. The Barberton underground operations were temporarily impacted by a switch to continuous-operating-cycle mining. The switch should improve future production efficiency. Gold produced declined by 14.8% to 175k oz. Revenue declined by 14.8% to $322m. EBITDA declined by 16.8%, due to a 3% higher AISC. HEPS declined by 19.38% to 3.15 US cps. Happily, guidance is for a much improved 2024 financial year, with 185k oz production forecast.

Holdings- Recent Results – August 2023

Omnia (OMN): 3% of the fund

Omnia manufactures and distributes fertiliser and explosives. It has a global footprint, and is well positioned to benefit from two powerful macro tailwinds:

Macro Tailwinds:

- Population Growth and Food Security: The world’s population is expected to increase by 25% (to 9.7bn), by 2050. Increased population and improved living standards will require agricultural production to increase by 60% over this time-frame. Increased food production will be hampered by increasing vulnerability to climate change. Substantial investment is required in compound based and green fertiliser, in order to maintain current crop yields, and achieve production and food quality. (Omnia produces a unique granular fertiliser and provides value added agronomy services, throughout southern African, Brazil and Australia).

- Decarbonisation: To mitigate the effects of climate change, a net-zero carbon emissions by 2050 goal, has been set by 33 countries and the European Union. Demand for critical minerals used in green energy technologies is expected to expand sevenfold in the next decade. Optimising blast solutions will be critical to a decarbonised world. (Omnia provides a world leading dual-salt emulsion blasting product, and provides blasting services to mining clients across Africa, Canada, Australia and Indonesia).

Margin Enhancement Initiatives:

Management have a detailed plan to significantly enhance margins over the next two years:

- Agriculture: Cost optimisation will be driven through manufacturing and production efficiencies, supply chain optimisation, as well as distribution and logistics efficiencies. Growth will be enhanced through the roll-out of the AgriBio business to international markets, as well as speciality fertilisers in South Africa. Volume growth in southern Africa will be achieved through increased AgTech services.

- Mining: Cost optimisation will be achieved through improved asset utilisation, production efficiency and expense management. Rationalisation of the West Africa operations will cut costs materially. Growth will be achieved through new distribution joint ventures in Canada, Indonesia and Australia. A new explosives product, AXXIS Titanium, will also be rolled out globally.

Recent Results:

Results for the 12 months to March 2023 demonstrated improved resilience. Despite lower volumes from adverse weather events, revenue increased 24% on the prior year, buoyed by higher commodity prices in the first half. Operating profit increased by 19% after accounting for losses on the disposal of the Zimbabwean Joint Venture. Profit for the year declined by 15% after materially higher tax charges. HEPS increased by 1% to 739c. Dividends were increased by 36% to 375cps. The company has zero debt, and generates a 12% return on average equity. Omnia plans to repurchase 10% of its outstanding shares, within the next 12 months.

Holdings- Recent Results – July 2023

Textainer (TXT): 8.8% of the fund

Textainer leases out containers to shipping companies. It is the second largest container leasing company in the world. It has been a fantastic investment for the fund:

Share Repurchases:

Textainer generates stable and resilient cash flows. Almost all of Textainer’s container fleet is leased out under fixed-rate, long-term, lease contracts. Gearing is high at 2.5x net debt to equity, but the average remaining lease and debt tenor is closely matched, at 5.7 years. (Effective interest rates are fixed at 3.22% pa). As capex opportunities have been limited, shareholder returns have been driven by share repurchases. Over the last 2.5 years, Textainer has repurchased 32% of its common shares. It plans to repurchase a further $139 million worth of shares (10%), over the next 12 months.

Demand for containers- driven by Greenhouse Gas Emission Regulation:

Member states of the International Maritime Organization have agreed to reach net-zero greenhouse gas emissions (GHG) by 2050. (Indicative checkpoints call for reducing total shipping GHG emissions by 30% by 2030, and for 80% by 2040, both relative to 2008). In order to reduce emissions, container shipping companies are being forced to reduce average sailing speeds. This reduces shipping capacity. To maintain existing capacity companies have ordered a significant number of new vessels. These vessels will be delivered over the next several quarters, and will drive expected demand for new container leases.

Recent Results:

Results for the second quarter to June 2023 were marginally softer, compared to the first quarter. Average fleet utilisation remained at 98.8%, but gains on sale of end-of-life containers decreased by 16%. Lease rental income decreased by 1% to $192m. Income from operations decreased 3% to $98m, adjusted net income decreased 4% to $51m. Adjusted EPS decreased 2% to $1.20.

Holdings- Recent Results – June 2023

Afrimat (AFT): 7% of the fund

Afrimat has made a series of acquisitions that have created significant shareholder value. Its strategy is to buy good companies, that have been poorly managed. It has a track record of buying them cheaply, and integrating them well. Its latest acquisition seems inspired:

Growth through Acquisition- Lafarge South Africa:

Afrimat has entered into a share purchase agreement with the owners of Lafarge South Africa (LSA). It has offered to pay $6m (R110m) for LSA, and settle its holding company loan account of R900m. LSA has R1.4bn in net assets, and generates a normalised EBITDA of R350m per annum. The replacement costs of the LSA asset base is estimated at between R10bn and R15bn. (The transaction is subject to the normal competition and regulatory approval). LSA produces aggregates, concrete, cement and fly-ash. The largest contributor to LSA’s earnings is cement, which at 2mt per annum accounts for 20% of the existing SA cement market. LSA will vertically integrate into Afrimat’s existing ready-mix and concrete blocks and bricks business. There seems to be little to no geographic overlap between LSA’s and Afrimat’s opencast lime and aggregates operations. Although construction activity is subdued, this acquisition positions Afrimat well for future recovery.

Core Business- Bulk Commodities:

Afrimat generates most of it operating profit (82%) from bulk commodities. The majority of this comes from the Demaneng iron ore mine, but Jenkins iron ore and Nkomati anthracite mines are ramping up volumes. These mines will be significant earnings contributors in FY2024. Construction materials revenue growth is flat, with pressure on operating margins. The future metals and materials division will add material value in the medium term, as the Glenover vermiculite and super phosphate operations start production.

Recent Results:

For the 12 months to February 2023 Afrimat generated a 24% Return on Net Operating Assets. Revenue increased by 5% but operating profit declined by 13% on lower iron ore prices and higher costs (Jenkins and Nkomati mines ramping up production front-loaded costs). Headline earnings per share decreased by 15.7% to 457.6 cps. HEPS have grown at 18.24% CAGR over the last 5 years.

Holdings- Recent Results – May 2023

Hosken Consolidated Investments (HCI): 16% of the fund

HCI is an investment holding company. It owns a large portfolio of assets, the most interesting of which is Impact Oil and Gas:

Impact Oil and Gas (49.9%):

Impact Oil and Gas (Impact) is a UK based hydro-carbon exploration company, which owns several deep water African oil and gas prospects. Its strategy is to partner with super-major oil companies, with technical and financial capability, to develop prospects into feasible projects:

- The Orange Basin Venus Project: Impact owns a 20% Joint Venture interest in two exploration prospects. These are situated in the Orange Basin, off the southern coast of Namibia. In both license areas, Impact has partnered with TotalEnergies (the operator), QatarEnergy and Namcor. The JV is collectively named the Venus Project. Last year Impact announced that a world-class light oil and associated gas field was discovered by the Venus Project. This discovery is believed to be at least 2bn barrels, and could increase with further exploration drilling, currently underway.

- Drilling Update: The Vantage owned drillship Tungsten Explorer, has completed the Venus-1A appraisal probe, about 13km north of the original discovery well. According to Upstream, an oil and gas exploration publication, the well hit the reservoir as expected. TotalEnergies has chartered the semi-submersible Deepsea Mira for an Exploration and Appraisal (E&A) Programme, which will start operating in July 2023. The ship will perform a production test on the Venus-1A site in Block 2913B. Once the Tungsten Explorer completes operations at Venus-1A, it will head west into Block 2912 to drill the critical Nara-1 probe, targeting the potentially massive western extension of Venus. If successful, the drillship will perform a drill stem test to measure well-flow-rates. It will then drill the Nara appraisal well, and do a drill stem test. After the Venus-1A production test the Deepsea Mira will perform a production test on the original Venus-1X discovery well. In April HCI invested R375m into Impact, to fund their portion of the current E&A Programme. It has committed to invest a further R530m by August 2023.

- Feasible Project- Sale: The E&A Programme should be completed by October 2023. If the Venus project is proved feasible, Impact intends to sell its stake. Proven reserves are roughly worth $3 to $5 per barrel. At 2bn proven barrels and a $4 valuation, HCI’s effective 10% interest in the JV could be worth R15bn. HCI’s current market-cap is R19bn.

Listed Holdings:

HCI owns the following listed companies: Tsogo Sun Gaming (49.7%), Southern Sun Hotels (40.5%), eMedia Holdings (80.3%), Frontier Transport (82.2%), Deneb Investments (85.3%) and Platinum Group Metals (25.1%).

Unlisted Holdings:

HCI owns the following unlisted companies: HCI Coal (100%), HCI Properties (100%), Karoshoek (10%), Impact Oil and Gas (49.9%), Gripp Advisory (75%), BSG (40%), Alphawave (42.3%) and La Concorde (89.4%).

Recent Results:

For the year to March 2023 income increased by 20%. EBITDA increased by 13% to R5.639bn. Headline earnings per share increased by 55% to 2051c. Hotels, gaming and coal were the largest contributors to growth, with hotel and gaming activity now close to pre-COVID levels. HCI’s stated NAV is R224.66 per share.

Holdings- Recent Results – April 2023

DRD Gold (DRD): 10.5% of the fund

Gold- Central Bank Buying:

The gold price is close to an all-time high. Chinese and Russian central banks have been notable buyers of gold. The move to diversify reserves into gold, seems to be a sustainable trend.

Converting mine-waste into gold:

DRD Gold is a capital-light, surface tailings recovery business. It uses a hydro-mechanical process to recover gold from old mine dumps, situated east and west of Johannesburg. DRD Gold produces 170k ounces of gold per annum, at an all-in sustaining cost of $1385 per ounce. Sibanya Stillwater owns 50.1% of DRD Gold. Though a series of acquisitions, Sibanya has built up a vast gold and platinum resource base, with valuable mine-waste assets. DRD Gold is well positioned to benefit from the development of these mine-waste assets, in the future.

Reducing Reliance on Eskom:

DRD is investing in renewable energy infrastructure. The installation of two 22KV lines that integrate Ergo and Brakpan/Withok tailings storage facility, into a dual Eskom and solar grid, is now complete. So is the medium voltage sub-station, through which surplus power will eventually be delivered back into the grid. The first phase of a 20MW solar farm, comprising 44 000 solar panels, will be fully commissioned by June 2023. At the City Deep pumping station, the unreliable City Power supply line has been abandoned, and a new cable directly to an Eskom sub-station has been installed. This has improved power supply, although the pumping station is still impacted by load curtailment, post stage 4 load-shedding.

Recent Results- Q3 of FY2023:

The operating update for the 3 months ended March 2023 was pleasing. This was largely due to a 11% increase in average gold price received. Gold production increased by 4% to 43k ounces (compared Q2), derived through a 13% increase in yield, and an 8% volume decline. Adjusted EBITDA increased 54% to R448m. Cash operating cost remained flat at $1208 per ounce. Cash on hand increased by R160m to R2.552bn. External borrowing remains at zero.

Holdings- Recent Results – March 2023

Master Drilling (MDI): 6.2% of the fund

Master Drilling owns a fleet of 140 raise-bore drill rigs. It hires these out to blue-chip mining companies on a contract basis, and supplies support (optimisation and safety) services. The knowledge derived from developing raise-bore technology, and supplying support services in multiple mining jurisdictions and commodities, provides a competitive advantage. (Its competitors are mainly manufacturers who sell equipment). Master Drilling measures its performance in terms of Average monthly Revenue per Operating Rig (ARPOR), and Fleet Utilisation. Compared to the prior year these metrics improved dramatically in 2022, with fleet utilisation at 77% and ARPOR at $155k, (70% and $136k).

Mechanised Mining:

Raise-bore drill rigs are used to drill ventilation shafts, for deep-level mines. A pilot hole is drilled from the surface, the raise-bore rig is then assembled underground, and the shaft, typically 4.5m in diameter, is drilled up to the surface. This technology is materially safer, and more efficient, than traditional blast-and-drill techniques. Master Drilling also owns and operates a fleet of 61 slim rigs (used in mining exploration), and a number of mobile-tunnel-boring machines. These are ideal for drilling incline shafts.

Digital Mining:

Master Drilling is increasing the tech-solutions and digital services, it provides to its fleet-hire customers. Data collection from drilling activities will be a key value enhancement. It is also benefitting from investments in subsidiaries A&R Group and AVA Solutions. A&R Group provides proximity detection systems. These prevent unsafe interactions between underground workers and machinery. (It currently monitors 250k people and items of equipment in Southern Africa and Mexico). AVA Solutions provides data collection mine management solutions, specifically load-and-haul tracking solutions for opencast mines.

Diversified Order Book:

Master Drilling has a diversified order book. As at December 2022, pipeline revenue was $570m, with $178m in committed orders. Of the committed orders 23% were from copper miners, 37% PGM, and 17% Gold. Revenue in 2022 was 40% derived from Africa, 31% from South America, 17% from Central and North America, and 12% from India, Europe and Australia. (Operating profit margins are highest in Africa at 21%, due to limited competition).

Recent Results:

For the 12 months to December 2022, revenue increased by 32% to $226m, and headline earnings per share increased by 10.1% (to 14.2 USD cents per share, or ZAR232.5 cps). Operating costs increased due to higher staffing requirements. Finance costs increased on higher debt levels, from expansion capex, and higher rates. Master Drilling generates a 12% Return on Equity, with little debt, at 8.2% of equity. A maiden dividend of ZAR 47.5 cps was declared.

Holdings- Recent Results – February 2023

Blue Label (BLU): 4.5% of the fund

Blue Label distributes digital products, primarily pre-paid airtime and electricity. It trades on 4 times normalised earnings*, and generates a 22% return on equity.

Shadow Bank:

Blue Label sells products for cash, and pays its suppliers on extended terms. Much like an insurance company, a pre-payment float can be invested to enhance returns. Over the last few years Blue Label’s float has been used to buy a controlling interest in Cell C. It plans to increasingly use the float to fund micro-loans, through a partnership with Capitec.

Cell C- Mobile Virtual Network Operator (MVNO):

Cell C has been recapitalised and restructured. Lower debt levels, together with lower costs from the migration of its clients onto MTN’s network, will result in Cell C’s return to profitability. Its MVNO joint venture with Capitec Connect, which sells airtime and data to Capitec’s 19m online customers, is expected to drive significant unit and margin growth. It plans to sell value-added data services to Capitec, which gives valuable insight into customer behaviour, resulting in better lending decisions.

Accessing the Informal Economy:

Blue Label allows the informal economy, to acquire vouchers with cash, and transact digitally. Its Aeon payments platform with integrated Postilion switch, links financial institutions, municipalities, and telco’s with thousands of contracted merchants. Cash customers purchase Blue Label vouchers from merchants’ point of sale system. Customers then use vouchers to purchase digital products, using a mobile device. Digital product include airtime, electricity, sports bets, transport and event tickets. This payments network has significant scale economies, and network effect benefits. As the platform gets larger, unit costs decrease to such an extent that competition becomes increasingly difficult. The platform becomes more valuable to customers as more merchants are added, and more digital products become available. This provides a sustainable competitive advantage. Cell C’s spectrum, in a bandwidth constrained world, is a valuable cornered resource. This also provides a sustainable competitive advantage.

Recent Results:

For the 6 months to November 2022 Revenue increased by 9%, (revenue from pin-less top-ups increased 4%, electricity increased 7%, gaming revenue increased 58% and ticketing revenue was up 152%). Gross Profit and Normalised Earnings Per Share (excluding IFRS adjustments relating to the Cell C recapitalisation)* increased 13%.

Holdings- Recent Results – January 2023

Hudaco (HDC): 5% of the fund

Hudaco is a value added distributor of imported industrial products. It generates a 22% return on equity.

Its businesses serve markets that fall into two primary categories:

- Consumer: It supplies products focused on the automotive aftermarket, power tool and fasteners, data networking, gas and outdoor, security and communication, and battery and sustainable energy markets.

- Engineering consumables: It supplies products focused on bearings and belting, electrical power transmission, diesel engine, hydraulics and pneumatics, specialised steel, thermoplastic fittings, and filtration markets.

Sustainable Competitive Advantage:

The sale of replacement parts and products, with a high value added component, leads to multiple repeat orders, with high margins. Hudaco has a significant scale advantage over its competitors. Its balance sheet size (R6bn), and wide branch network, allows for high stock availability and extensive product range, at locations close to customer demand. Its limited need for fixed asset investment, makes Hudaco a resilient high return company.

Recent Results:

Results for the 12 months to November 2022 were excellent. The synergies and consolidations implemented over the last two years have resulted in significant market share gains. Compared to the prior period, turnover increased by 12% to a record R8.2bn. Operating profit increased by 23%, headline earnings per share by 22%. Final dividends per share increased by 20%, after R133m share repurchase.

Holdings- Recent Results – December 2022

Hosken Consolidated Investments (HCI): 12% of the fund

HCI is an investment holding company. It trades at a significant discount to its intrinsic value. Over the next few years this discount will be narrowed through the sale its major Namibian oil and gas discovery- Venus, and the unbundling of its listed holdings.

Impact Oil and Gas:

HCI owns a 49.9% interest in Impact Oil and Gas. Impact is a UK based hydro-carbon exploration company. It owns a portfolio of high quality, deep water prospects, off the coast of Africa. Its strategy is to partner with large oil and gas companies (with technical and financial capability), to develop prospects into feasible projects:

- Namibia- Venus has made a major oil and gas discovery: Impact owns a 20% Joint Venture interest in the Block 2913B license area, and a 18.89% interest in the adjacent block 2912, in an area known as the Orange Basin. In both license areas, Impact has partnered with TotalEnergies (the operator), QatarEnergy and Namcor, collectively named the Venus Project. Last year Impact announced that a world-class light oil and associated gas field was discovered by the Venus Project. There are early indications that this could be a multi-billion barrel discovery. In the next few months the Tungsten Explorer drill-ship will drill one more appraisal well, and re-enter the Venus-1X exploration well, to run a test and acquire additional seismic data in Block 2912. This work will allow the JV to better understand the scale of the Venus discovery, and the degree it extends west into Block 2912. Impact has stated it intends to sell its 20% JV stake, once this process is complete.